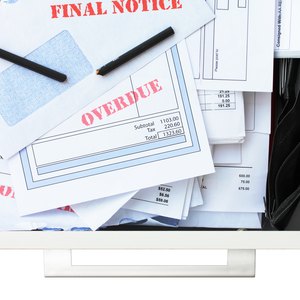

If you feel like you never have any money in your bank account and you're living from paycheck to paycheck, you're probably spending too much money.

Here are five signs that your spending is out of control and a few ideas on how to solve the problem.

1. You’re Only Making Minimum Payments on Your Credit Cards

Only paying the minimum required on your credit cards is a sure sign of spending too much. Credit cards usually charge high interest rates and making only the minimum monthly payment means that you're just paying interest every month, and it’ll take years to pay off the balance on your credit card. You have to make a deliberate effort to pay more than the minimum amount to reduce the amounts you owe on credit cards.

In addition, a large part of your credit rating is based on the utilization rate of your credit cards. Cards that are maxed out will have a significant negative effect on your credit score, which means you could either be turned down for other loans or have to pay higher interest rates, leading to higher monthly payments, such as on your car loan.

Even worse, taking cash advances on your credit cards means you’ve run out of money. Cash advances carry even higher fees and interest rates and make it more difficult to get out of credit card debt.

Your credit card utilization rate shouldn't be higher than 30 percent.

Read More: Credit Card Debt Relief: What Are My Options?

2. You Don’t Have a Savings Account or Emergency Fund

If you don't have a savings account, or even if you have one but you never have any money left to add to it, then you're likely spending too much money.

A savings account should be a mandatory use of funds just like paying your rent, making a car payment and buying groceries. If your strategy is to add to savings at the end of the month with whatever money is left over, there will never be any money left over for savings. You have to set up a savings account and assign a fixed amount of money to come out of every paycheck for savings.

What about an emergency fund? Unexpected expenses happen with surprising regularity. A sudden car problem can drain your bank account if you don’t have funds set aside to cover unexpected expenses. A good target is to have at least three to six months of expenses in an emergency fund.

Read More: Basic Budget Plan for Low-Income Family

3. You Don’t Have a Budget

Spending too much money can be the result of not having a budget. If you haven't analyzed your spending and compared it to your own budget, your spending will be out of control. You don’t know how much you’re spending or where it’s going.

Not having a budget can lead to spending sprees and buying things you don't need. For example, you may even have subscriptions you didn’t know were still active and you don’t use. That’s a waste of money.

A budget will act as a control on your spending and enable you to spend your money in the areas that will improve your finances the most, like paying off credit cards and other debts.

4. You Don’t Know How Much You Owe

If you don't know exactly how much you owe, your spending is out of control.

One way lenders gauge a borrower’s risk is to calculate their debt ratio. The formula for the debt ratio is the total monthly fixed payments divided by your monthly income. It’s important for you to know how much debt you have so you can calculate this ratio and understand its effect on your ability to get a mortgage or be approved for a car loan.

A high debt ratio could be the cause of your inability to get credit approval for loans.

Read More: How to Make a Personal Weekly Spending Budget

5. You’re Always Stressed Out

Being stressed out about money is a sure sign you’re overspending.

You’re probably stressed out because you’ve missed payments on your car loan and you’re behind with your utility bills. You may even have some medical bills that have been sent to collections, and you’ve resorted to taking payday loans against your future paychecks. It seems like an endless cycle, and you can never catch up.

You can’t think about or plan for the future because you’re too worried about paying the bills today. If this sounds like you, it's time to take charge of your finances and make some changes.

How to Get Control of Your Spending

Get a grip on your finances. Start by looking at your bank statement and find out where your money is going. Then set up a budget and decide where you want your money to go.

A good rule of thumb to allocate your income is the 50/30/20 ratio. This means that 50 percent of your after-tax income should go to essentials such as rent, groceries and utilities. The 30 percent is for things you want such as vacations, eating out, movie tickets, internet and subscriptions. The remaining 20 percent should be directed to savings accounts, an emergency fund and debt repayments.

If you don’t have a savings account, open one up with your bank. The first goal is to build up your emergency fund account and then open another account that can be used for savings. If at first you find it difficult to allocate 20 percent of your income to savings, start out with 5 percent and gradually increase the percentage each year. You'll be surprised how quickly you'll be able to adjust and work up to the 20 percent target.

Start paying more than the minimum required on your credit cards. If you have a decent credit score, contact the credit card issuer and ask for lower rates. Another option is to take advantage of any 0 percent introductory offers you get in the mail from other credit card issuers for balance transfers. If you have a low credit score, focus on paying down your debt and paying your bills on time.

Above all, avoid cash advances on your credit cards and pay cash with a debit card for your expenses.

If your total debt ratio is above 40 percent of your income, work on getting this figure down. You may have to consider moving to another place with lower rent or driving a less expensive car. However, the results will be worth it when you see your debts coming down and the balances in your savings accounts going up.

References

Writer Bio

James Woodruff has been a management consultant to more than 1,000 small businesses. As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company's operational, financial and business management issues. James has been writing business and finance related topics for work.chron, bizfluent.com, smallbusiness.chron.com and e-commerce websites since 2007. He graduated from Georgia Tech with a Bachelor of Mechanical Engineering and received an MBA from Columbia University.