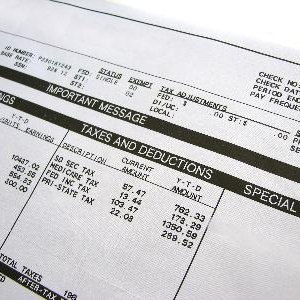

Getting a paycheck usually feels great -- for you and Uncle Sam. When you look at your pay stub, you'll see all of the money withheld for various taxes, some federal and some state and local. In some cases, however, you won't have any taxes withheld, but this doesn't mean you're off the hook.

Income Taxes

Any applicable income taxes, including federal, state and local income taxes, are generally withheld from your paycheck. The amount of the withholding depends on the number of exemptions and filing status claimed on Form W-4, which you fill out when you start a new job. Obviously, if you live in a state or locality without income taxes, you won't have have state and local taxes withheld.

Payroll Taxes

Payroll taxes, which include the Social Security tax and the Medicare tax, are also withheld from your paycheck. The Medicare tax is 1.45 percent for both you and your employer. In 2012, the Social Security tax is 4.2 percent for you and 6.2 percent for your employer, but in 2013 both rates will be 6.2 percent unless changes are made. The Medicare tax applies to all your income, no matter how much you make. The Social Security tax, on the other hand, applies only to a limited amount. As of 2012, the limit is $110,100, but it is adjusted for inflation. Any wages above the limit don't have Social Security taxes withheld.

Claiming Exempt

When you complete your W-4 at the start of your employment, you have the opportunity to claim that you are exempt from withholding because you didn't owe any taxes the year before and you won't owe any taxes for the current year. However, this exemption only applies to income taxes, not payroll taxes, so you'll still have the Social Security and Medicare taxes taken out of your paycheck.

Independent Contractors

If you work as an independent contractor, you won't have any taxes withheld from your paycheck -- either income taxes or payroll taxes. While this may sound great, don't celebrate. You're still responsible for income taxes and, instead of payroll taxes, self-employment taxes. Self-employment taxes are equal to the sum of the employee and employer portion of the payroll taxes, because you are essentially your own employer as well as being the employee. You usually have to estimate what these taxes are and pay them quarterly to the IRS.

References

- Internal Revenue Service: Tax Withholding

- Internal Revenue Service: Form W-4

- Social Security Administration: Social Security & Medicare Tax Rates

- The Cato Journal: Evolution of Federal Income Tax Withholding: The Machinery of Institutional Change

- Internal Revenue Service. "Understanding Employment Taxes." Accessed Nov. 29, 2019.

- Social Security Administration. "Contribution And Benefit Base." Accessed Sept. 29, 2020.

- Internal Revenue Service. "Publication 15 (2019), (Circular E), Employer's Tax Guide." Accessed Nov. 29, 2019.

- Internal Revenue Service. "Topic No. 756 Employment Taxes for Household Employees." Accessed Dec. 5, 2019.

- Social Security Administration. "Contribution And Benefit Base." Accessed Nov. 11, 2019.

- Internal Revenue Service. "Questions and Answers for the Additional Medicare Tax." Accessed Nov. 29, 2019.

- Internal Revenue Service. "Self-Employment Tax (Social Security and Medicare Taxes)." Accessed Nov. 29, 2019.

- Social Security Administration. "Disability Insurance Trust Fund." Accessed Dec. 5, 2019.

- Social Security Administration. "Old-Age & Survivors Insurance Trust Fund." Accessed Nov. 29, 2019.

- Social Security Administration. "Chronology." Accessed Nov. 29, 2019.

- Social Security Administration. "The Evolution of Social Security's Taxable Maximum." Accessed Nov. 29, 2019.

- U.S. Centers for Medicare & Medicaid Services. "How Is Medicare Funded?" Accessed Nov. 29, 2019.

- U.S. Centers for Medicare & Medicaid Services. "What Part A Covers." Accessed Nov. 29, 2019.

- U.S. Centers for Medicare & Medicaid Services. "What Part B Covers." Accessed Nov. 29, 2019.

- U.S. Centers for Medicare & Medicaid Services. "Drug coverage (Part D)." Accessed Nov. 29, 2019.

- U.S. Centers for Medicare & Medicaid Services. "Medicare Costs at a Glance." Accessed Nov. 29, 2019.

Writer Bio

Based in the Kansas City area, Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by "Quicken," "TurboTax," and "The Motley Fool."