A stock split does not change the value of a company or an investment in its stocks. It merely rearranges the number of shares and the price per share. For example, if a company with a million shares outstanding that trade for $10 each does a 2-for-1 split, the company would then have two million shares outstanding priced at $5 each. In both cases, the company's market capitalization is $10 million. Similarly, an investor who owns a stock that splits should notice a change in the price and number of shares, but not in the total value of his investment.

Check price per share. The most obvious place to spot a split is in the price per share. Stocks can split in any ratio, from 3-for-5 to 10-for-1, and can even reverse split, which results in fewer shares but increases the price per share. A sudden, dramatic change in the stock price from one day to the next isn't necessarily a split, but it could be.

Look at the number of shares and value of your investment. If you happen to own shares of a company and notice a big change in the price per share, check the number of shares in your account and the overall value. If the number of shares has changed, but the value hasn't, the stock has split. If the number of shares has not changed, but the value has, the price fluctuation is most likely not the result of a stock split.

Check the headlines. Another way to check if a stock has split is to scour the financial news. If a major company splits its stock, it will undoubtedly make a headline. A micro-cap stock might be grouped with other stock splits, but its stock split will almost certainly appear in the financial media somewhere. Even if you're looking for a past split, scanning through old company-specific headlines should yield results.

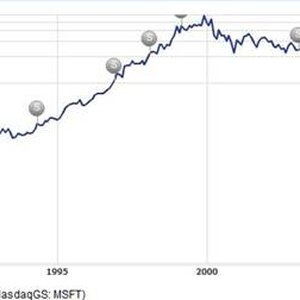

Find a chart. If you're curious to see whether a stock has split in the past, one way to find out is to find a historical chart that shows splits, like the one for Microsoft pictured above. Most charting services automatically adjust their data for a split so there is no discontinuity in the chart. However, some services, such as Yahoo Finance, will show where splits have occurred if you select this filter option.

Ask investor relations. If all else fails, ask the company. Almost all publicly traded companies have websites with an investor relations area. A recent stock split should be easy to find. Past splits would be found either under a section about stock price history or among old press releases, depending on the company. If you're still not sure, you can call the investor relations department and ask a live person for more information.

References

- How do you express 1/3^-2 with positive exponents? | Socratic

- Net investors struggle with stock split calculations

- Apple. "Investor Relations: FAQ." Accessed March 4, 2020.

- Apple. "Investor Relations: Stock Price." Accessed March 4, 2020.

- Macrotrends. "Citigroup Market Cap 2006-2020." Accessed Sept. 3, 2020.

- Yahoo. "Citigroup Inc. (C)." Accessed Sept. 3, 2020.

- Citigroup. "Citigroup Effects Reverse Stock Split; "C" Begins Split-Adjusted Trading on NYSE Today." Accessed March 4, 2020.

Writer Bio

Joseph Nicholson is an independent analyst whose publishing achievements include a cover feature for "Futures Magazine" and a recurring column in the monthly newsletter of a private mint. He received a Bachelor of Arts in English from the University of Florida and is currently attending law school in San Francisco.