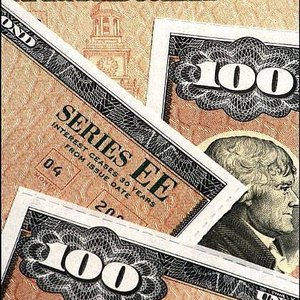

Paper savings bonds are easy and safe long-term investments that are guaranteed by the U.S. government. You can still purchase paper bonds from your local banking institution or purchase their equivalent online and own them electronically.

Bring proper identification, Social Security number, current address and funds to your local bank and speak to a customer-service representative (tellers do not typically sell the bonds).

Include the name, address, and Social Security number of the person for whom you are buying the bond if it is not yourself. If you are purchasing the bond for a minor, you may choose a co-owner.

Select the type and denomination of bond you wish to purchase.

Fill out a purchase application and pay for the bond.

Take the receipt. The actual bond will be sent to the address provided within three weeks.

Tips

If you wish to own the investment without the paper, you can purchase and hold the bonds electronically. Visit the Savings Bond website and follow the procedure to purchase online. You can also manage them, chart their progress and cash them out online.

References

- TreasuryDirect.gov. "Series I Savings Bonds." Accessed Feb. 7, 2020.

- TreasuryDirect.gov. "Tax Considerations for I Bonds." Accessed Feb. 7, 2020.

- TreasuryDirect.gov. "Series I Savings Bonds FAQs." Accessed Feb. 7, 2020.

- TreasuryDirect.com. "Treasury Inflation-Protected Securities (TIPS)." Accessed Feb. 7, 2020.

Tips

- If you wish to own the investment without the paper, you can purchase and hold the bonds electronically. Visit the Savings Bond website and follow the procedure to purchase online. You can also manage them, chart their progress and cash them out online.

Writer Bio

Linda Emma is a long-standing writer and editor. She is also a digital marketing professional and published author with more than 20 years experience in media and business. She works as a content manager and professional writing tutor at a private New England college. She holds a bachelor's degree in journalism from Northeastern University.