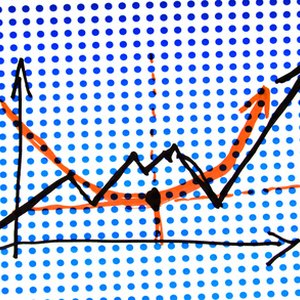

Investors look for long-term growth opportunities and buy stocks based on the assumption their price will grow over time. They ignore the ups and downs that occur along the way. Those price fluctuations, however, offer profitable opportunities for those with shorter time frames in mind. There are many different methods stock traders use to flip stocks for short term profits.

Breakouts

Many times, a stock price will trade in a relatively flat range below a level of resistance. Resistance is the price level where the stock has turned back under selling pressure several times. Stocks that break out above resistance oftentimes continue to move significantly higher. Breakout traders buy when the price moves above resistance. If you use this method, it is a good idea to place a sell stop order with your broker just below resistance. This will cause you to sell if the breakout fails and the price falls lower once again.

Trend Trading

Stock prices generally trend about 30 percent of the time. The rest of the time they vacillate randomly in a trading range. Future price action is significantly more predictable when a stock is trending in one direction. A popular way to trade a trending stock is to buy when the stock pulls back to a clear trend line. Using the drawing tool on your stock chart software, connect recent price bottoms. This will allow you to see the trend more clearly. Typically, stocks find buyers when the price pulls back to the trend line, which can be used as your buy point.

Channel Trading

When a stock is not trending, it is ranging. Oftentimes the trading range presents itself in a clear horizontal price channel. The top of the channel represents resistance and the bottom of the channel represents support -- the area where buying has recently caused the price to reverse higher. Channel traders simply buy at price support and sell at price resistance.

Contrarian Trading

Stock prices tend to overreact. When prices are moving higher, buyers become greedy. When prices move lower, buyers become fearful. Contrarian traders use various market sentiment indicators, such as the put/call ratio, volatility index and others to determine if investors are becoming too greedy or too fearful. Contrarians buy when fear is too high and sell when greed is too high.

References

- Swing Trade Stocks: Trading Stock Trends

- The Pattern Site: Bulkowski’s Candle and Chart Pattern Breakout

- BetterTrader. "Higher-Highs and Higher-Lows vs Lower-Highs and Lower-Lows." Accessed May 29, 2020.

- Fidelity. "Support and Resistance." Accessed May 29, 2020.

- Charles Schwab. "How to Identify and Use Triangle Patterns." Accessed May 29, 2020.

- Forex Training Group. "False Breakouts and Fakeouts Can Be Profitable Setups." Accessed May 29, 2020.

Writer Bio

Donald Harder has been writing financial-related articles since 2000 when he founded the firm Securities Research Services. He has worked as a speech writer for the U.S. Department of Justice and written white papers and studies for the U.S. Department of Housing and Urban Development. Harder holds a Master of Arts in international affairs from George Washington University.