A bank statement will include all transactions and account activity for your particular account. Some statements will include all of your accounts, such as checking, savings, certificate of deposits and money market accounts. Each section of the bank statement will include a variety of different information. To prepare a bank statement, you will need information that identifies the customer. Statements are usually mailed to customers on a monthly basis for their review. Customers can review and question any unauthorized charges.

Enter the customers personal information at the top of the statement. The customer’s name, address and account number will appear at the top of the statement. Every customer has a different account number so that accounts can be distinguished from one another. The address is usually the mailing address where the statement is delivered by mail.

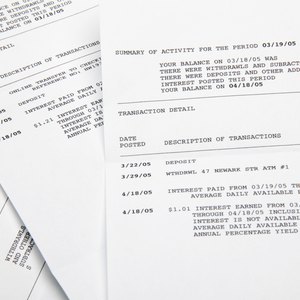

Complete the account summary section. The next section will include the account summary, including the current balance, funds on hold, total available balance and the balance as of the last statement. There will be a category for interest earned if your account pays interest. A date range will appear as well. The account summary section will capture all activity for a specific period of time such, as from July 16 until August 16.

Enter the account activity section of the statement. The next section will feature all of the transactions that have taken place on the account. This section will have the following subheads: date of the transaction, check number, description of the transaction, deposit, withdrawal and balance. Some of the transactions listed should include, checks paid, deposits to the account, withdrawals, automatic payments, debit card transactions and bills paid. All ATM transactions will appear as well. The balance will appear after each transaction has been processed or completed.

References

Writer Bio

Melvin J. Richardson has been a freelance writer for two years with Associated Content, and writes about topics such as banking, credit and collections, goal setting, financial services, management, health and fitness. Richardson has worked for several banks and financial institutions and gained invaluable experience and knowledge. Richardson holds a Master of Business Administration in Executive Management from Ashland University in Ashland Ohio.