A merger occurs when two firms become only one firm. In the financial news it is often used in the phrase "mergers and acquisitions." Finance experts, economists and businessmen have argued and bickered about the effect of merger activity on the acquiring firm's stock price since the 1960s. The conclusions of the debate have been decidedly mixed.

Merger Basics and Terminology

Mergers can occur in many forms. In most cases the purpose of the acquiring firm is to increase shareholder value, but there can be other purposes as well. Some mergers are “hostile” as in the the financial media phrase “hostile takeover,” meaning that the board of the target company isn't willing to sell their shares. Sometimes hostile merger attempts can become “friendly” takeovers, when the board of the target company eventually assents to the merger, often after the acquiring firm has sweetened the deal for the target company.

Mergers and Stock Price Research

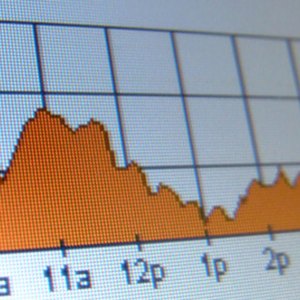

Mergers can affect two relevant stock prices: the price of the acquiring firm after the merger and the premium paid on the target firm's shares during the merger. Research on the topic suggests that the acquiring firm, in the average merger, typically doesn't enjoy better returns after the merger. As noted in an article in the "Journal of Management" by Jeraryr Halebliean, et. al, recent research suggests that acquisitions can erode the acquiring firm's value. On the flip side, research also suggests that target firms are typically bought at a premium to share price before the merger. Target shareholders, therefore, tend to fare well, sometimes experiencing positive returns.

Mergers and Motivation

Despite these research findings, merger activity has been increasing over the past ten years, prompting curiosity into why mergers continue to occur. Selfish managers may be seeking the benefits that tend to flow from large firms (like corporate jets and corner offices). Managers may be interested in achieving more market power or may be seeking "too big to fail" status for their firms. Mergers can even occur for regulatory purposes or for tax purposes. Because some mergers don't occur for purely economic reasons, analyzing the merger on its own terms is usually the best way to determine whether the merger will be profitable.

Practical Advice for Shareholders

With a little research, you can find out whether merger activity on a stock you own will be beneficial to your bottom line, or whether it might be a sign of disaster. If you find yourself on the target side, congratulations! It's likely that even if your firm isn't doing well, you'll do fine thanks to the premium paid by the acquiring firm. If you're a shareholder in the acquiring firm, be cautious, but don't panic. Some mergers can make the acquiring firm more profitable, even if most don't. First, analyze financial reports for the companies. If a firm you're not familiar with has shoddy financials, most likely the new conglomerate may be a bad investment. Second, learn the specifics of the buyout, including key information about potential benefits for shareholders and other considerations. Use this information to make a judgment call on the merger itself. Trust your business instincts and your common sense -- a doughnut company merging with a law firm won't make either firm better, but a doughnut company merging with an orange juice firm or a coffee shop chain just might.

References

- A Random Walk Down Wall Street. Burton G. Malkiel. 2007, New York NY.

- Managerial Economics and Business Strategy, 6th edition. Michael R. Baye. 2009 McGraw-Hill, New York NY.

- Sam Houston State University. "Merger & Consolidation: Overview." Accessed May 18, 2020.

- Daimler. "DaimlerChrysler AG Merger." Accessed May 18, 2020.

- DaimlerChrysler. "Merger of Growth," Page 7. Accessed May 19, 2020.

- The Walt Disney Company. "Disney to Acquire Pixar." Accessed May 18, 2020.

Writer Bio

Collin Fitzsimmons has been writing professionally since 2007, specializing in finance and the stock market. He serves as a financial analyst at AMF Bowling Centers, Inc. Fitzsimmons earned a bachelor's degree in economics from the University of Virginia.