There's nothing more fun than winning when you gamble, especially if you win the lottery. Of course, for the millions of people who fail to accomplish this, there is the consolation of a potential tax deduction. Not that that compares with winning millions of dollars and spending the rest of your life on an island in the Caribbean.

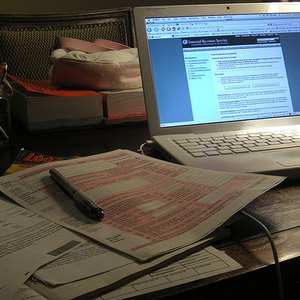

Total all of your itemized deductions to see whether you are eligible to itemize. If you are, then enter your itemized deductions on the appropriate line on Schedule A of the Form 1040.

Add up all of your miscellaneous itemized deductions on line 28 of Schedule A. These include partnership losses, pension investment losses and several other assorted expenses, including gambling losses to the extent of winnings.

Add up all of your gambling winnings for the year, if any, and then your losses, including all lottery ticket expenses. Compare the two totals.

Deduct all of your losses as miscellaneous itemized deductions if they total less than your winnings. Deduct only the amount of losses equal to your winnings if your winnings exceeded your losses.

Enter the total of your deductible losses on line 28 of the Schedule A. Be sure to clearly list your losses as such next to their total on the form. Include the total as part of your itemized deductions and subtract the total at the bottom of Schedule A from your adjusted gross income listed on your Form 1040.

Tips

See IRS Publications 505 and 525 for more information

References

- IRS website Schedule A instructions

- IRS Schedule A

- IRS. "You Won! What Now?" Page 2. Accessed April 23, 2020.

- IRS. "Topic No. 419 Gambling Income and Losses." Accessed April 23, 2020.

- IRS. "IRS Provides Tax Inflation Adjustments for Tax Year 2020." Accessed April 24, 2020.

- IRS. "Publication 529 (Rev. December 2019) Miscellaneous Deductions." Page 10. Accessed April 23, 2020.

- IRS. "Instructions for Forms W-2G and 5754 (2020)." Accessed April 23, 2020.

Writer Bio

Mark Cussen has more than 17 years of experience in the financial industry. He received his B.S. in English from the University of Kansas and became a Certified Financial Planner in 2001. He has published financial educational articles on such websites as Investopedia and Money Crashers. He also provides financial education and counseling for members of the U.S. military and their families.