An investment portfolio works in several different ways towards the ultimate goal of preserving and generating wealth. Global financial markets are complex and diverse enough that money can be made in any investment environment. The greatest challenge in making an investment portfolio work is knowing exactly what to do when.

One of the safest ways an investment portfolio generates money is through fixed income investments. These are usually in the form of bonds issued by corporations or governments or from dividends paid to shareholders by a corporation. Issues effecting fixed income are the credit worthiness, or default risk, of the issuer, and the yield earned by the bondholder. Safer lenders, such as those of governments or blue-chip companies, typically pay a lower yield--at times, so low that the real return after inflation is at or below zero! On the other hand, a company or government that goes bankrupt will be unable to pay its high dividends or service its debt. Yields between 3% and 7% are generally considered safe. When an investor sells something for more than they paid for it, they're said to have realized a capital gain. This sort of buying low and selling high is, of course, the goal of most investors. To do this successfully, however, requires patience, discipline and a deep knowledge of macroeconomic trends. In an environment when an economy is growing, most assets will tend to rise in value, making capital gains relatively easy to come by. Asset allocation is much more difficult and crucial in a period of stagnant or contracting growth. During these times, investors will have to monitor capital flows to know which assets can maintain their value or appreciate while others decline. Capital gains can be realized over a very long period of time, which is recommended for most novice investors, or over a very short period of time, as little as a few minutes or hours for risk-taking day traders.

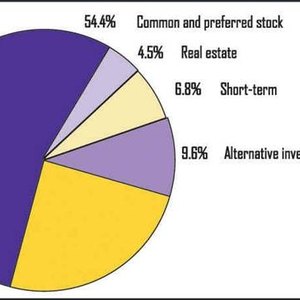

To mitigate the risks of asset allocation within a portfolio, managers diversify their holdings. This means they invest partially in fixed income while pursuing capital gains across the risk spectrum with other investments. If done correctly, diversification will vastly reduce risk while preserving growth potential. One asset class that got increased attention from portfolio managers recently was commodities. Traditionally, commodities were only traded on futures exchanges in contracts for delivery, which made them inconvenient for traditional portfolio investment. The proliferation of exchange-traded funds and exchange-traded notes backed by commodities futures, at a time when commodities in general were appreciating rapidly, led many managers to make commodities a permanent asset class in their portfolios.

Writer Bio

Joseph Nicholson is an independent analyst whose publishing achievements include a cover feature for "Futures Magazine" and a recurring column in the monthly newsletter of a private mint. He received a Bachelor of Arts in English from the University of Florida and is currently attending law school in San Francisco.