Tired of living paycheck to paycheck without any cushion or savings? Sounds like it's time to create a budget. Even people who don't make a lot of money can find ways to live within their means and even put a little something away. The key is knowing what you have coming in, taking a serious look at what you have going out and determining where you can make changes.

Tally All Income Streams

The first step is knowing how much money you have coming in each month. Add up all income, gifts and other forms of income you receive each month. So, if you make $1,800 a month, your spouse makes $1,500 a month and you receive $200 a month from a side business, your income each month is $3,500. This amount should be your take-home pay, the amount you receive after taxes and other deductions are made.

Track All Expenses

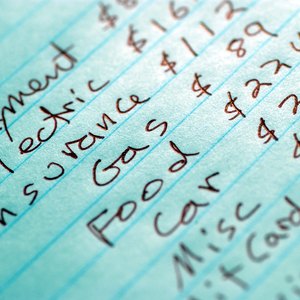

Gather all of your expenses. Literally all of them. Utility payments, such as your electric and water bills, your rent or mortgage, credit card bills, student loan payments, grocery expenses, insurance, car payment – anything that requires payment each month should be included.

Simple.com suggests you break out the bank statements and credit card statements so you don't forget anything. Add up all of your expenses and discover you pay out $3,600 a month.

Decide What's Essential

Now that you know how much you're paying out each month, it's time to decide which expenses are necessary and which you could either lower or eliminate completely.

For example, your rent or mortgage is essential since it ensures you have a place to live. Putting $500 a month on your credit card to eat out or buy a pair of shoes, however, is not really essential. Paying your water and electric bills means you have lights and running water. Coffee every morning from the coffee shop down the street and eating take-out lunch every day is probably not essential.

Be honest as you go through your expenses and decide what you have to pay and put everything else on a separate list. So let's say that after you sort your expenses, you determine that $3,000 are essential and $600 worth of expenses are not essential.

Determine What's Optional

The expenses that you deemed weren't essential are now part of your optional expenses. You've also probably realized that you are spending more than you are bringing in, even if the difference is only $100 a month. The overspending means you have higher credit card bills and no savings. If living within your means and being able to save are your ultimate goals, then these optional expenses should be either eliminated completely or severely cut back.

Locate Saving Opportunities

You most likely do not want to give up getting your morning coffee, grabbing lunch with your coworkers or shopping for that perfect pair of shoes completely, so you'll need to look for ways to save while you do these things. Instead of getting coffee and going to lunch every day, maybe cut down to three days a week for each. Or you can wait until shoes are on sale to buy them.

Using coupons when you grocery shop could result in a significant saving on your food bill. If you cut your optional expenses by half ($300) and you save $100 using coupons when you shop, your $100 over budget drops to $300 under budget.

Put a Little Away

Now you might be tempted to spend that $300 on other things. Don't. This is your chance to put some money away for a rainy day.

You can save the entire $300 in an investment account where you can't touch it without losing money, or you can keep part of it and save it for something fun. Having something to look forward to makes saving money easier. So, stash $200 in a retirement account or rainy day fund, and save $100 toward a vacation or an extravagant purchase.

References

Writer Bio

K.A. Francis has been a freelance and small business owner for 20 years. She has been writing about personal finance and budgeting since 2008. She taught Accounting, Management, Marketing and Business Law at WV Business College and Belmont College and holds a BA and an MAED in Education and Training.