If you earn any kind of income, you’ve likely dealt with income taxes. And if you own real estate then you’ve also been quickly introduced to the concept of property taxes. Both of these represent typical annual taxes that government agencies levy on citizens to generate income used for government programs. The good news is these taxes only come once a year; the bad news is that they cost a lot.

Background

American taxes include a variety of charges in everyday life. Some of these taxes are at point of contact like sales taxes, and some are charged based on activity during a year. Annual taxes are typically designed to charge for aggregate activity or status of person for a tax year. A tax year many times is similar to a calendar year but it can also be a 12-month period of whenever a government agency wants to manage a given annual tax.

Annual taxes are not limited to one level of government. Federal, state and even city governments have income taxes, counties and special districts levy property taxes, and all government levels have specialized annual taxes they collect.

Federal Income Tax

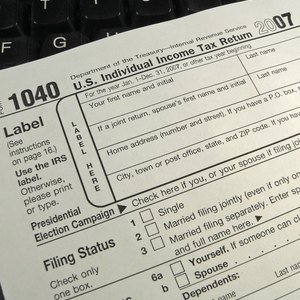

The most commonly paid and well-known annual U.S. tax would be income tax. Taking a person’s gross income for a calendar year, adjusting it for certain exceptions and credits and allowing deductions, the federal government levies a charge on income earned, which increases as more income is brought in. Most people earning less than $40,000 a year generally avoid paying annual income taxes after adjustments, but workers and married couples earning more find themselves paying thousands of dollars every year.

State Income Tax

Similar to the federal government, almost all 50 states levy their version of income tax as well. Filers pay such taxes at the same time federal income taxes are due, which makes the administration and processing easier for the government agencies involved. A few states do not have income taxes whatsoever, including Nevada, Washington, Alaska, Florida and Texas.

Federal Insurance Contributions Act Tax

Collected from earners’ paychecks or from estimated tax payments sent in to the Internal Revenue Service, the Federal Insurance Contributions Act tax (FICA) is a salary-driven charge to help pay in to Social Security and Medicare (retirement health insurance for seniors). Earners who generate enough payment credits (years of recognized work earnings) can collect on these benefits later in life as needed. These taxes are collected monthly, then the final charge is balanced out as earners file their income taxes.

Property Tax

Unlike salary-driven annual taxes, property tax represents an annual charge for the right to own real estate property. The tax is generally driven off a percentage of the value of the property when it was bought. However, some agencies may have formulas for changing the annual amount based on assessments or periodic adjustments. Property taxes are levied by county or municipal governments, and while annual they are frequently broken out into two payments.

Withholding

Some taxes are paid once or twice a year, while others are prepaid monthly. Income taxes and salary-driven taxes are prepaid by withholding from an earner’s paycheck. These amounts are then balanced once a year on income tax filings. If the earner paid too much, the excess is returned. If the earner didn’t pay enough, the balance is due when the income tax filings are submitted, frequently on April 15 following a tax year.

References

Writer Bio

Since 2009 Tom Lutzenberger has written for various websites, covering topics ranging from finance to automotive history. Lutzenberger works in public finance and policy and consults on a variety of analytical services. His education includes a Bachelor of Arts in English and political science from Saint Mary's College and a Master of Business Administration in finance and marketing from California State University, Sacramento.