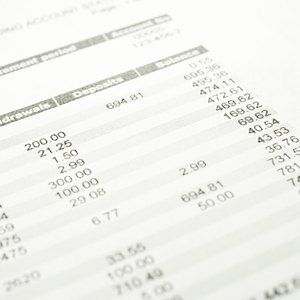

Although the burden of proof is on you to provide proof of income to prospective lenders or landlords, the supporting paperwork they require is their call. Some may only need to see your most-recent bank statement – or bank statements for the last two or three months – but others may need a little more documentation than that. It typically depends on the type of credit you’re seeking and the source(s) of your income.

Verification of Income for Home Purchases

Banks, savings and loan institutions, and private investors are in the pool of lenders that finance mortgages. Because of the substantial amounts of most mortgage loans, and their often-lengthy terms, lenders require more than a simple bank statement to verify the incomes of their applicants on loan-approval documents. Although each lender's underwriting guidelines vary, be prepared to produce pay stubs, investment portfolios and all sources of asset income you may have. Collectively, this represents your total income, which is reduced by the taxes you pay plus your monthly expenses to yield your net income. A lender considers all these factors when calculating your debt-to-income ratio to determine whether you qualify for a mortgage loan.

Verification of Income for Rental Homes

If a prospective landlord needs to confirm your income, she may ask only for your recent pay stubs or an income verification letter from your employer. At the discretion of the landlord, you may also have to provide additional proof of income, but qualifying for a rental home is not as stringent as qualifying for a mortgage loan. Some landlords only require prospective tenants to list their income on the rental application without having to produce substantiating paperwork.

Verification of Income for Other Types of Consumer Loans

Banks, savings and loans institutions, credit unions, finance companies and auto dealerships are examples of lenders you might consider if you want to purchase an automobile, finance personal or household items, or obtain a personal loan. Depending on the item you want to finance, the amount of the loan and the lender, you may be able to submit only your bank statement as proof of income. Each lender has its own approval guidelines, so you may also have to provide additional documents, such as pay stubs or tax return forms, to support your ability to repay the loan.

Verification of Income if You're Self-Employed

You're under the loan-qualifying microscope a little more if you're self-employed. You may have to produce more financing application documentation, and a longer history of income, than salaried or hourly-wage employees. Tax returns, 1099 forms and receipts for business expenses may be among the additional documents you're required to produce. And although your bank statement may also be required to confirm the deposits you've made to your account, it will be only a small piece of the big picture for showing proof of your income.

Verification of Income Using Financial Statements

If you're self-employed, the IRS offers record-keeping guidelines to help you prepare financial statements. IRS Publication 583 "Starting a Business and Keeping Records" notes the supporting documents you need to prepare income statements and balance sheets such as sales slips, paid bills and invoices. When you present a well-organized and comprehensive financial statement to a prospective lender, your proof of income is substantiated far beyond what appears solely on your bank statement.

References

Writer Bio

Victoria Lee Blackstone was formerly with Freddie Mac’s mortgage acquisition department, where she funded multi-million-dollar loan pools for primary lending institutions, worked on a mortgage fraud task force and wrote the convertible ARM section of the company’s policies and procedures manual. Currently, Blackstone is a professional writer with expertise in the fields of mortgage, finance, budgeting and tax. She is the author of more than 2,000 published works for newspapers, magazines, online publications and individual clients.