If you've ever gotten a paycheck, you know that at any job your take-home pay is lower than the advertised salary. That's because, at the very least, taxes are withheld from your paycheck. You might have other items withheld from your paycheck as well, including insurance premiums and retirement contributions. You'll need to deduct these from your salary to calculate your monthly take-home pay.

Tips

In order to calculate your monthly take-home pay, you will need to deduct any items withheld from your pay, such as insurance payments and retirement contributions, in addition to your standard taxes.

Exploring Tax Withholding

Every time you get paid in the United States, various taxes are withheld from your paycheck. This includes Social Security and Medicare contributions, sometimes referred to as FICA, as well as federal income tax. If you live in a place that has state or local income tax, those taxes also will be withheld.

The exact amount of tax that is withheld depends on your tax rate, which is based on how much money you make and other factors such as how many dependents you have. You can use a withholding calculator on the Internal Revenue Service website to estimate how much tax you'll owe at the end of the year and how much should be withheld from your regular paychecks. You can use this information to compute your monthly take-home pay and change your withholding information if it is incorrect.

The IRS calculator only covers federal tax, but you can find additional calculators and paper forms to help you in jurisdictions with state and local tax.

Other Important Deductions

There could be other costs deducted from your regular paychecks aside from the tax. For instance, you might have health, dental, vision or life insurance premiums deducted from your paychecks. If you have a flexible spending account program to pay for health or other expenses, those costs will be deducted from your paycheck too.

Additionally, if you have a 401(k) or another employer retirement plan, your contributions typically are deducted from your paycheck. You also might sign up to have charitable contributions, such as to United Way, deducted from your paycheck.

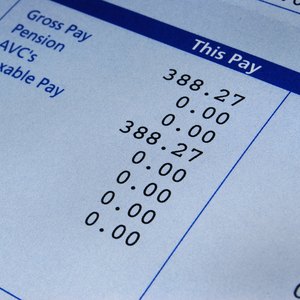

You can see how much is deducted from each paycheck by looking at your pay stub or by consulting your employer.

Putting It All Together

To figure out your monthly take-home pay, add together all of the regular deductions from your paycheck: insurance premiums, taxes and contributions to any retirement plans or flexible spending accounts.

Then, figure out how many paychecks you get in a year. For instance, if you're paid bimonthly, you'll receive 24 paychecks in a year, while if you're paid every other week, you will get 26. Ask your employer if you're unsure.

Then, multiply the total amount you have deducted and withheld from each paycheck by the number of paychecks you get in a year to get your total withholdings and payroll deductions for the year. Subtract this number from your annual salary to learn your yearly net pay. Divide that number by 12 to find out your average monthly take-home pay.

Note that if you're paid on a weekly or biweekly basis rather than monthly or bimonthly, your exact net pay likely will vary based on when pay periods fall within different months.

References

Writer Bio

Steven Melendez is an independent journalist with a background in technology and business. He has written for a variety of business publications including Fast Company, the Wall Street Journal, Innovation Leader and Ad Age. He was awarded the Knight Foundation scholarship to Northwestern University's Medill School of Journalism.