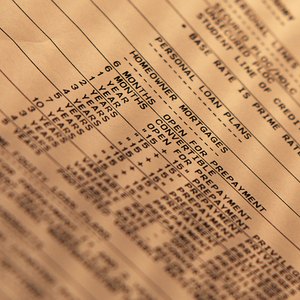

Restructuring a mortgage is changing the terms and conditions, usually to accommodate your budget and save money. There are several ways to restructure your mortgage.

Significance

The government has programs that allow you to modify your mortgage if you meet certain terms and conditions. Check with your mortgage lender for information. You could get an interest rate reduction.

Considerations

A mortgage can also be refinanced. When you refinance your mortgage, you have the option of extending or shortening the term. You can also receive a lower rate of interest.

Recast

A mortgage can also be recast. If you have paid your principal balance down substantially, your lender can recast your loan, which means your payments are readjusted based on the current balance. Your payment term starts over but with a smaller balance. Sometimes you have to pay a fee.

Benefits

Some lenders will push a portion of your principal balance to the back of the loan or to the maturity date. Lenders call this process principal forbearance. This part of your balance does not have to be repaid until the end of your loan term. This lowers your monthly payments.

Features

Each program will have different requirements and qualifications.

References

Writer Bio

Melvin J. Richardson has been a freelance writer for two years with Associated Content, and writes about topics such as banking, credit and collections, goal setting, financial services, management, health and fitness. Richardson has worked for several banks and financial institutions and gained invaluable experience and knowledge. Richardson holds a Master of Business Administration in Executive Management from Ashland University in Ashland Ohio.