A mortgage assumption is a process by which a home buyer simply takes over the mortgage loan payments of the original homeowner. While this practice has waned in popularity in the 21st Century, it is still a procedure that may still be available to homeowners. It is also important to understand that, when assuming an existing mortgage, you may be forfeiting certain tax advantages by not originating a new loan. Some of the advantages may remain intact, too.

Mortgage Credits

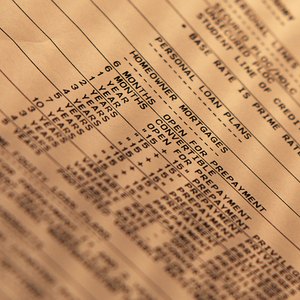

There are a number of tax advantages that a mortgage can bring you. The most substantial tax break is the mortgage interest tax deduction. This procedure allows you to write off all of the interest you paid on your mortgage over the year, thereby dramatically reducing your total tax liability. Another advantage is the mortgage points deduction. You are also eligible to write off certain fees, such as origination fees, that you paid in the last year of your loan.

Tax Advantages: Assuming a Mortgage

If you do assume a seller's mortgage, you will still be eligible for the home mortgage interest deduction each year on your taxes, so long as you are paying mortgage interest on the assumed loan. This deduction may be smaller, however, since the greatest amount of interest on a home mortgage is paid earlier in the amortization schedule. Therefore, you will likely be assuming a mortgage that has less interest to pay.

Tax Disadvantages: Assuming a Mortgage

The most significant tax disadvantage to assuming a mortgage is the inability to deduct mortgage fees and points on your taxes. While it will be nice to not have to pay these points for an originated mortgage, the tax benefit lowers your total tax burden, which could result in less due on your taxes each year. However, some lenders have changed assumption policies and may require an origination fee on your assumed mortgage. In this case, this becomes tax-deductible.

Credit Qualifications

It is important to remember that you must qualify, both in terms of credit and income, prior to assuming an existing mortgage. If you are unable to qualify for an assumed mortgage, you could be eligible to qualify for new originated mortgages. In this case, all of the tax breaks that are available for new homeowners (including a new homeowner tax credit) will also be available to you. In some cases, even with strong creditworthiness, you may not qualify for an assumed mortgage simply because the existing mortgage is not insured by the Federal Housing Authority or the Bureau of Veterans Affairs; therefore, in this case, you must seek other mortgage lending options.

References

- Internal Revenue Service: Home Mortgage Interest Deduction

- Bankrate.com: Assumable Mortgage: Take Over Sellers Loan

- Consumer Financial Protection Bureau. "What Is Private Mortgage Insurance?" Accessed Oct. 31, 2020.

- Internal Revenue Service. "Publication 936 (2019), Home Mortgage Insurance Deduction." Accessed Oct. 31, 2020.

Writer Bio

Based in Eugene, Ore., Duncan Jenkins has been writing finance-related articles since 2008. His specialties include personal finance advice, mortgage/equity loans and credit management. Jenkins obtained his bachelor's degree in English from Clark University.