Interest rates can be confusing. Sometimes they are expressed as an annual rate (i.e. APR), sometimes they are expressed for the compounding period (i.e. interest per month), or as annual percentage yield (APY). The confusion is that all of these numbers mean different things when applied to real world situations. Effective Interest Rates (EIR) help to compare the varying numbers with one tool.

Types of Interest

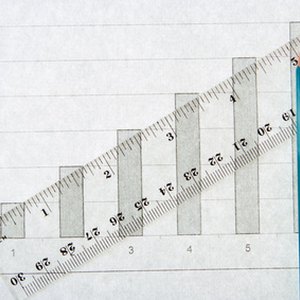

The two main types of interest are simple and compound. Simple interest figures a one-time percentage applied to the principle. For example, $100 with a simple interest of 10 percent will total $110. Compound interest, however, adds the interest to the principle regularly (e.g. monthly or semi-annually). So a compound interest rate of 10 percent on $100 will yield a new principal of $110 after the first compounding period and then the next compounding period the principal will increase to $121 ($110 + $11). The rate at which the interest compounds can drastically affect the impact that the interest rate has on the principle balance.

Inflation

In addition to the type of interest, the effects of inflation impact the real value of the money. Inflation is the "sustained, rapid increase in the general price level" of good and services according to the Business Dictionary. As rate of inflation increases, the value of money decreases. The average rate of inflation in the U.S. is about 2 to 4 percent a year, so each year goods and services cost that much more and your money will buy that much less.

APR

The common way to refer to interest is as an annual percentage rate and in the United States it is regulated by the Federal Deposit Insurance Corporation (FDIC). Essentially the APR must include all of the costs and fees associated with borrowing money and express that as a percentage per year.

Effective Interest Rate

Effective Interest offers a way to calculate the real cost of borrowing money. Included in the calculations are the rate of inflation and the compounding schedule. The calculations for effective interest are expressed as a yearly percentage rate.

Differences

While the APR is the regulated standard means of expressing interest on a loan, effective interest gives the borrower a more comprehensive picture of the situation. Use the APR to differentiate between loans since it offers a standardized metric. Use effective interest to decide if a loan is right for you because it offers a real world picture of the cost.

References

Resources

Writer Bio

James T Wood is a teacher, blogger and author. Since 2009 he has published two books and numerous articles, both online and in print. His work experience has spanned the computer world, from sales and support to training and repair. He is also an accomplished public speaker and PowerPoint presenter.